Wang ChuanFu's most respected company --- Huawei

If business is a jungle where the lion is king, then the wolves are looking to usurp the throne.

At least that's how many Chinese experts see the battle to drive competitive innovation in industry and manufacturing.

While Western executives are learning business acumen from the sixth Century BC Chinese classic, The Art of War by Sun Tzu, Chinese industry leaders are being told to study one of their contemporaries.

The "wolf culture" of privately-owned Chinese telecommunications giant Huawei is a more visceral strategy for survival than Sun Tzu's analytical tract -- it stresses innovation with the message "Get on top and stay there."

Huawei's founder and CEO Ren Zhengfei has described the wolf spirit as a blend of three qualities: extreme resilience in face of failure, a strong willingness to self-sacrifice, and sharp predator instincts.

"In the battle with lions, wolves have terrifying abilities. With a strong desire to win and no fear of losing, they stick to the goal firmly, making the lions exhausted in every possible way," the media-shy Ren is reported to tell his staff.

AHEAD OF THE PACK

Originally a low-cost manufacturer of products designed by others, Huawei determined to shed its copycat image and move up the value chain when competition at home and abroad intensified in the 1990s.

As an underdog in a market dominated by multi-nationals, it had to prise open its share inch by inch -- and it had to provide better and cost-effective products and services.

To kindle a spirit of innovation, Huawei encouraged its staff to study wolves.

"When you feel real threat of being eliminated by your rivals, the more thirst you will have for designing innovative products," says Chen Naixing, director of the Research Center for Small and Medium-sized Enterprises (SMEs) at the Chinese Academy of Social Sciences (CASS).

WORKING FOR CUSTOMERS

In 1988, with 20,000 yuan (2,942 U.S. dollars) borrowed from his relatives and friends, 44-year-old ex-serviceman Ren Zhengfei founded Huawei as a distributor of imported exchange switches for a Hong Kong company.

The 2010 Fortune Global list published by the U.S. magazine "Fortune" ranked Huawei at number 397 with annual sales of 21.8 billion U.S. dollars and net profits of 2.67 billion U.S. dollars in 2009.

Unlike many of its Chinese counterparts, Huawei has a strong commitment to creating long-term value for its customers by being responsive to their needs and requirements.

"We exist to serve customers, whose demand is the driving force behind our development, and we measure our work against how much value we bring to customers, because we can only succeed through our customers' success," Huawei's founder Ren once said.

Forty-six percent of Huawei's 95,000 staff work on R&D, on which the company persistently spends at least 10 percent of its revenues. Even during the economic downturn in 2009, the company increased R&D spending by 27.4 percent from 2008 to 13.34 billion yuan (1.6 billion U.S. dollars).

With 17 research institutes in the U.S., Germany, Sweden, Russia, India, and Italy and other countries, mainly employing local engineers, it has also set up more than 20 joint innovation centers with top operators such as Vodafone.

Tuesday, August 31, 2010

Wednesday, August 25, 2010

Did Buffett buy into BYD for the auto? (old clip)

From BYD's 2010 1st half report

As an important part of the “Silicon-Iron” strategy of the Group, the energy storage station business also made a major breakthrough during the period. By leveraging on the supporting policies of the State on new energy development, the Group actively participated in new energy projects associated with such policies, including the construction and demonstration operation of solar power stations and energy storage stations. During the Period, two 100KW energy storage stations in Beijing and Shanghai were delivered for use and put into demonstration operation. As for the Wind-PV Energy Storage and Transmission Project with China Electric Power Research Institute, relevant contracts have been signed and delivery of batteries and other related equipment have started. Further, the Group had a number of Megawatt-class energy storage station projects in bidding stage. During the Period, the Group collaborated with renowned overseas residential property developers by installing BYD household energy system for their property developments, which may, through a solar power generation system and together with an energy storage station, achieve complete independence of household energy to power grid systems.

Monday, August 23, 2010

Lou Simpson retiring from Geico

Lou Simpson, the Chicago-based investor with such a stellar track record he once was considered the successor to Warren Buffett, is retiring at the end of the year after decades managing Geico's investment portfolio.

Geico is owned by Buffett's investment vehicle, Berkshire Hathaway. Simpson, 73, who grew up in Highland Park, is the only person other than Buffett who controls Berkshire investments.

"I wish he weren't" retiring, Buffett told me. "Obviously, I would keep him employed till he was 100. I was very surprised when he called me a month ago and said, 'At 74, I'd just as soon turn it over to somebody else.' It was not a happy day at Berkshire. But I'm happy for him."

The two have never delineated their stock picks; Geico's investments are described publicly as Berkshire's. So for about 15 years, reporters and Wall Street analysts often assumed Simpson's moves were Buffett's.

Geico is owned by Buffett's investment vehicle, Berkshire Hathaway. Simpson, 73, who grew up in Highland Park, is the only person other than Buffett who controls Berkshire investments.

"I wish he weren't" retiring, Buffett told me. "Obviously, I would keep him employed till he was 100. I was very surprised when he called me a month ago and said, 'At 74, I'd just as soon turn it over to somebody else.' It was not a happy day at Berkshire. But I'm happy for him."

The two have never delineated their stock picks; Geico's investments are described publicly as Berkshire's. So for about 15 years, reporters and Wall Street analysts often assumed Simpson's moves were Buffett's.

Tuesday, August 17, 2010

China Orders 100,000 electric vehicles manufactured by the Daimler-BYD joint venture?

If true, the order made by the Chinese government for 100,000 electric vehicles manufactured by the Daimler-BYD joint venture will surely become the biggest such contract for electric vehicles signed to date. And, according to sources cited by es.autoblog.com, it is as true as it gets.

Apparently, the Chinese government will be the biggest customer for the joint-ventures future electric vehicle. China expects the huge order to be honored by 2012, but the financial terms of the deal have not yet been disclosed.

The huge order for EVs is likely to put the smile back on BYD execs' faces, after earlier this week they were forced to announce a decrease of the target for 2010.

比亞迪 唱衰台灣電動車

台灣官方與業者積極推動電動車研發,但大陸電動車領導廠比亞迪汽車總經理劉振宇卻不看好台灣發展電動車,他說,比亞迪的電動車應該很快就會賣到台灣,台灣買買大陸的就好了;台灣沒原料、沒市場,「耗在這上面,死路一條」。

在大陸素以說話直白聞名的劉振宇,是比亞迪能從電池行業成功介入汽車產業的關鍵人物。

比亞迪汽車從2003年成立就積極研發電動汽車,劉振宇表示,七年來的成果就是目前大家看到的油電混合車「F3DM」和純電動車「e6」。劉振宇對於比亞迪電動車的技術頗為自豪,他指出,比亞迪始終「貼在技術最高峰」。對於台灣也有意發展電動車,劉振宇直言不諱說,「台灣不要想了」。

曾於2000年到台灣參觀過主要車廠的劉振宇說,「我到台灣汽車廠看了,真可憐」。「日本所有(車)廠在台灣都有兒子,合搞個發動機(引擎)還搞不出來。我們比亞迪搞發動機,簡直沒有感覺。我們現在發動機1升的、1.3升、1.5升、1.6升、1.8升、2.0升,全部都有了。我們搞東西速度之高,不是你們能想像的。」

今年5月27日,賓士母公司戴姆勒與比亞迪簽約,雙方合資成立深圳比亞迪.戴姆勒新技術公司,共同研發新一代電動車,預計2013年將推出首款電動車。劉振宇說,戴姆勒很聰明,不想從零開始搞電池,所以找比亞迪合作,「走我們的老路你就只能走在後面」。

為扶持電動車發展,大陸6月起在上海、深圳、杭州、長春、合肥等地試辦補貼個人購買電動汽車,純電動車每輛最高補貼金額達人民幣6萬元(約新台幣28.3萬元)。不過,劉振宇表示,影響電動車市場前景最關鍵還是油價。「哪個小子再把石油整到(每桶)140美元了,這車就搶了」。

他強調,比亞迪絕不會等油價高漲再積極投入電動車。「我們能領先絕不往後退。我們看清楚了,那玩意趨勢是往上走,不會下來的」。

U.S. Economy Faces `Painful Period' of Debt Unwind, Berkshire's Sokol Says

The U.S. is facing a “painful period” in the next five years as homeowners and governments unwind debt built up during the housing boom, Berkshire Hathaway Inc.’s David Sokol said today.

“All of that just feeds into a slow-growth environment,” Sokol, who heads Berkshire’s energy and luxury-flight divisions, said today in an interview at Bloomberg headquarters in New York. “If we could average 2 percent for the next five years, we’d be pretty happy.”

“It’s going to be a painful period,” said Sokol, whose energy division owns a real-estate brokerage. “If the U.S. grew a consistent 2 percent from this year forward, Europe half a percent and Asia 6.5 to 7 percent, my guess is that we’ll all feel pretty good.”

The credit crisis in 2008 was “such a dramatic jolt to businesses that it did something very positive,” Sokol said. “It made companies that were pretty efficient get a lot more efficient. It made every business I’m involved with really take a hard look at the business model.”

“People have been shocked into the notion that maybe some monthly savings is a good thing,” Sokol said. “We’ll end up with a lot of people that are struggling until their home values come back a little bit.”

Sokol considers his main job at Berkshire to be “whatever Warren wants me to do,” he said in an interview today on Bloomberg Television.

“All of that just feeds into a slow-growth environment,” Sokol, who heads Berkshire’s energy and luxury-flight divisions, said today in an interview at Bloomberg headquarters in New York. “If we could average 2 percent for the next five years, we’d be pretty happy.”

“It’s going to be a painful period,” said Sokol, whose energy division owns a real-estate brokerage. “If the U.S. grew a consistent 2 percent from this year forward, Europe half a percent and Asia 6.5 to 7 percent, my guess is that we’ll all feel pretty good.”

The credit crisis in 2008 was “such a dramatic jolt to businesses that it did something very positive,” Sokol said. “It made companies that were pretty efficient get a lot more efficient. It made every business I’m involved with really take a hard look at the business model.”

“People have been shocked into the notion that maybe some monthly savings is a good thing,” Sokol said. “We’ll end up with a lot of people that are struggling until their home values come back a little bit.”

Sokol considers his main job at Berkshire to be “whatever Warren wants me to do,” he said in an interview today on Bloomberg Television.

Wednesday, August 11, 2010

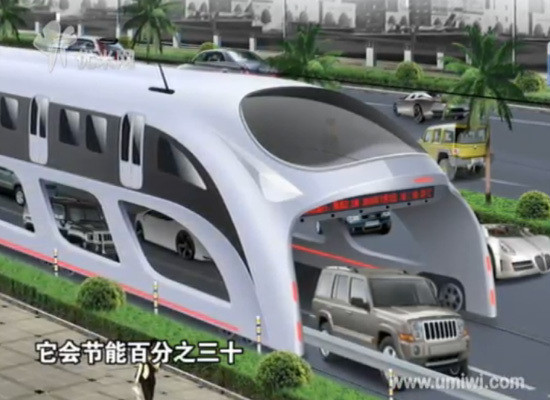

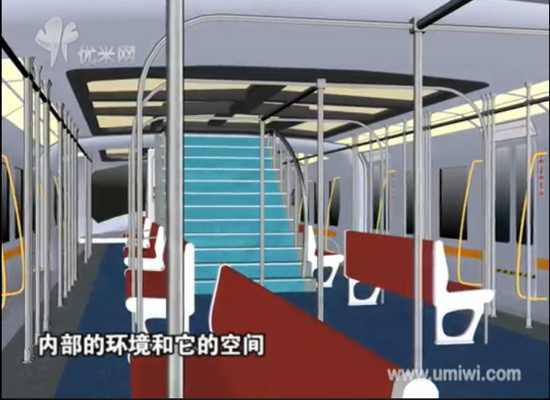

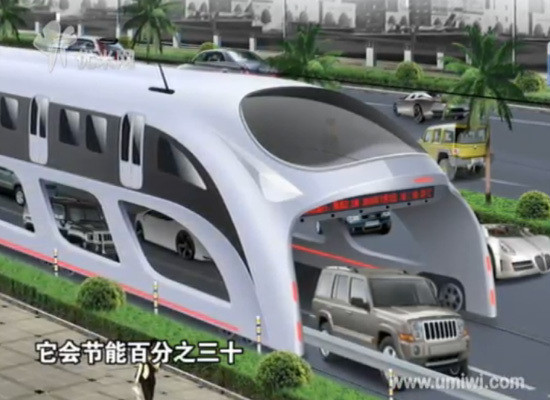

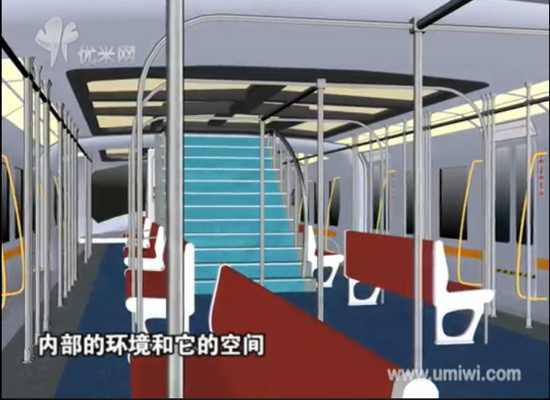

Futuristic bus design in China

China has overtaken the United States as the world's biggest producer of greenhouse gases and biggest energy consumer.

Link

But the country is also thinking in big and bold ways when it comes to how it will reduce pollution and a new plan to build a "straddling bus" is among the most space-age schemes yet.

In an effort to go green and relieve congestion without widening roads, the Shenzhen Huashi Future ParkingEquipment company is developing a "3D Express Coach" (also known as a "three-dimensional fast bus").

According to China Hush, the 6-meter-wide 3D Express Coach will be powered by a combination of electricity and solar energy, and will be able to travel up to 60 kilometers per hour carrying some 1200 to 1400 passengers.

Wednesday, August 4, 2010

Tuesday, August 3, 2010

Richard Koo: Lessons from Japan's Decline

Richard Koo is the Chief Economist of Nomura Research Institute, the research arm of Nomura Securities, Tokyo. Before joining Nomura in 1984, Mr. Koo, a US citizen, was an economist with the Federal Reserve Bank of New York (1981-84). Prior to that, he was a Doctoral Fellow of the Board of Governors of the Federal Reserve System (1979-81). In addition to conducting financial market research, he has been appointed by several different Japanese prime ministers to a number of key committee positions to study the future of the Japanese economy. He has been named the top analyst of the Japanese economy and has spearheaded the national debate in Japan on how best to save the country’s ailing banking system.

Dan Richards interviewed Koo at the CFA conference in Boston in May.

Let's start by talking about some of the lessons from the problems that Japan had in the last 20 years. Can you quickly summarize the two or three conditions that led to Japan’s economic woes starting roughly in 1989?

We didn't realize that we had contracted a different disease. We thought it was the typical cyclical downturn where we fell into recession, but it was a very different type of disease altogether. The disease was caused by a massive nationwide asset price bubble that was financed with debt.

Real estate in particular?

Real estate, the stock market, and everything else. When that bubble collapsed, asset prices fell, but the liabilities remained. Balance sheets all over Japan in the private sector were underwater. Although they were bankrupt, the cash flow of many of these companies was still very good. Japan continued to run one of the largest trade surpluses in the world. So companies had the cash flow, but balance sheets were underwater.

If you put anyone in that situation, what would they do? They will use the cash flow to pay down debt, because shareholders don't want to be told that their shares were just a piece of paper. Bankers don't want to be told that their loans are all nonperforming. Workers don't want to be told that there are no more jobs tomorrow. For all the stakeholders involved, the right thing to do was to use the cash flow to repair their balance sheets.

The problem is, when everybody does that all at the same time, what happens to the national economy? If someone is saving money or paying down debt, you better have someone on the other side borrowing and spending money. In the usual world, we have the financial sector in the middle taking the money from this side and giving it to people on that side. If there are too many people who want to borrow money, interest rates rise; if there are too few, you bring interest rates down, and the money circulates in the economy.

But what we discovered when our bubble burst was that even with zero interest rates, no one was borrowing money. Everybody was paying down debt, because their balance sheets were all underwater. No one wanted to borrow money.From a public policy perspective, what can governments do when faced with this kind of situation?

That's the key issue now going forward. We learned that once we fall into this type of recession, where everybody is paying down debt and no one is borrowing money, monetary policy is the first casualty, because people with balance sheets that are under water are not interested in borrowing money at any interest rate. They have to repair their balance sheets as quickly as possible. So you bring interest rates down to zero, and nothing happens.

In Japan, we had rates almost zero starting in 1995, and the recession lasted until 2005; for 10 years nothing happened. I see the same thing happening here in the US, in the UK, and in other parts of the world. Rates are the lowest in history, and still there is very little response from the private sector.

So, monetary policy is not a solution. How about fiscal policy?

Fiscal policy is the solution. The government cannot tell the private sector, “please don't repair your balance sheets,” because the private sector has no choice. They have to repair their balance sheets. But if the private sector continues to save and other parts of the private sector are not borrowing, government has to borrow that money and spend it in order to keep the GDP from falling.

Let me give you an American example. If I have $1,000 on income, and I spend $900, and I decide to save $100, the $900 is already someone else's income. So this is not a problem. But under usual circumstances, someone will take the $100 that we saved, spend it, and then $900 plus $100 is $1,000 against the original income of $1,000, and the economy will swallow it.

In a balance sheet recession, the $100 gets stuck in the financial system. It cannot go out, because borrowers are trying to repair their balance sheets. If you do nothing about the situation, the economy is down to $900. If the $900 is someone's income, and that person decides to save 10% (and has $810 to spend), then $90 is going to the financial sector. But this $90 gets stuck, because people are still repairing their balance sheets.

If you do nothing about the situation, the economy will go from $1,000 to $900 to $810 to $730 very, very quickly. The last time anything like this actually happened was the Great Depression in the United States from 1929 to 1933, when the US lost half of its GDP in just four years, through the process I just described.

The only way to keep this process from happening is for the government to borrow the $100 and put that back into the income stream, then it is $900 plus $100 again, and there is no reason for GDP to fall.

Japan faced this problem throughout the 15-year period [that began in 1989]. The net debt repayment by companies was over 6% of GDP and household savings were 4% of GDP. We could have lost 10% of GDP every year, but we managed to keep our GDP from falling below its value at the peak of the bubble for the entire 20-year period, because government was borrowing and spending that money. So, fiscal policy is the key.

Is the US suffering from a lack of demand?

Exactly, demand collapses. In this case, and in this case only, the government has to step in and borrow the excess savings in the private sector, and put that back into the income stream.

Until the private sector deleveraging is over, those actions have to be in place for the whole period. We already have had a fiscal stimulus in United States – a $787 billion package enacted in February of last year.

We learned in Japan that this stimulus has to remain in place until this process is over. The mistake we made in Japan was that once the economy began to improve, we said, “The budget deficit is still large.” We cut the stimulus, and the economy weakened again. We put in another stimulus, and the economy improved. Then we said, “The budget deficit is too large.” We cut it. It went down. That's why it took us 15 years.

How long should the US and other economies – such as England or other European countries – continue with their stimulus efforts?

Given that the bubble itself wasn't as bad as the one in Japan, and the US and UK have the Japanese example to look at, they will recognize that this is not the same disease as a garden-variety recession. If everything is done correctly, it might take maybe five years. But if the US makes the same mistakes we made in Japan, such as in 1997 when we tried to cut the budget deficit prematurely, then the whole thing can go on much, much longer.

The prescription that you’re putting forward is for potentially five years of deficit spending by governments to maintain demand. How do you respond to someone who says well, that's what Greece has been doing, and look at the mess that they are in? There is a flight from Greek bonds because the markets are very nervous. How do you address those concerns?

The Greek problem is a totally different one, because they were increasing their budget deficit without what I call a balance sheet recession happening. They were spending like crazy for no good reason whatsoever. I don't think we should compare Greece with what's happening in the US or the UK, even though the budget deficit numbers may look similar.

In the US and UK there is definite evidence that the private sector is deleveraging. That occurring with zero interest rates is very unusual. In those economies, and those economies only, we have to rely on fiscal stimulus.

节能与新能源汽车规划曝光 千亿财政支持

中国的新能源汽车产业的国家战略正在加速形成。搜狐汽车得知,工信部牵头制定的《汽车与新能源汽车产业发展规划》(2011~2020年)已经制定完成,目前正在各相关部委征求意见,这个阶段结束后将上报国务院批准,成为中国新能源汽车产业发展提纲挈领的政策。

搜狐汽车看到的这份《规划》包括节能与新能源汽车发展形势分析、目标、任务、保障措施等几方面,涉及节能与新能源汽车关键技术的研发、推广、基础设施建设、标准制定、税收政策支持、关键零部件发展、准入管理等内容。

《规划》提出,将纯电动汽车作为我国汽车工业转型的主要战略取向,同时,持续跟踪研究燃料电池汽车技术,以试点示范为突破口,推进纯电动汽车、插电式混合动力汽车产业化,实现我国汽车工业跨越式发展。

最近,工信部组织汽车企业和一些专家对该《规划》进行了修改,因此,不排除本文披露的内容与最终版本有所差别。

发展目标:市场规模世界第一

普通混合动力汽车实现大规模产业化。具有自动起停功能的微混系统成为乘用车标准配置。中/重度混合动力乘用车保有量达到100万辆以上。

纯电动汽车和插电式混合动力汽车初步实现产业化。市场保有量超过50万辆(或为100万辆,规划制定者对此存有分歧,尚不清楚最终版本的表述),形成与市场规模相适应的基础设施体系。

形成支撑电动汽车大规模产业化的关键零部件产业体系。实现动力电池关键材料和生产装备的国产化。动力电池系统能量密度达到120瓦时/公斤以上,成本降低至2元/瓦时,寿命稳定达到2000次循环或10年以上。形成关键零部件大型企业集团。动力电池、电机等关键零部件分别形成3-5家骨干企业,产业集中度超过60%。

混合动力汽车实现大规模普及,中/重度混合动力乘用车年产销量达到300万辆以上。

纯电动汽车和插电式混合动力汽车实现产业化,市场保有量达到500万辆(或为1000万辆,规划制定者对此存有分歧,尚不清楚最终版本的表述)以上,充电站网络支撑纯电动汽车实现城际间和区域化运行。动力电池系统能量密度达到200瓦时/公斤以上,成本降低至1.5元/瓦时以下。

在结构调整方面,《规划》提出要形成3-5家新能源汽车整车骨干企业,形成2-3家具有自主知识产权和较强国际竞争力的动力电池、电机等关键零部件骨干企业,产业集中度达到80%以上。

中央财政的投入分为以下几个方面。

三,2011-2015年,中央财政共安排50亿专项资金支持试点城市的基础设施建设。试点城也加大对基础设施建设财政补助力度或贷款贴息,并且应在电价、土地等方面出台支持政策,充分调动电网企业、石化企业等社会各界进行基础设施建设的积极性。

四,设立节能与新能源汽车零部件固定资金投资专项资金,2010-2015年中央财政共安排100亿元,对节能与新能源汽车零部件进行分类指导和支持,引导社会资金投向节能与新能源汽车零部件生产领域,培育一批骨干配套企业。

消息人士表示,上千亿元是规划制定者的预期,最终国务院批复的支持资金额度也有可能略少于这个数目。

在中央财政补贴之外,各地方政府也将对新能源汽车的研发、推广投入资金,目前,各地制定的地方版节能与新能源汽车发展规划都包括数以亿计的支持资金,此外,各汽车企业也将投入巨资,除了自身的研发投入以外,承担重大科研专项的企业都必须按照一定比例投入配套资金。此外,相关政策还将引导社会资金投向新能源汽车产业,鼓励设立新能源技术创业投资机构和产业投资基金。

据此,搜狐汽车认为,未来十年,包括中央、地方政府以及企业等各方的投资,将达到数千亿元、甚至上万亿元之巨。

新能源汽车税收或减或免

《规划》内容显示,未来十年,政府的税收政策将给予节能与新能源汽车的推广以很大优惠。比如,免征纯电动汽车、充电式混合动力汽车车辆购置税,减半征收普通混合动力汽车车辆购置税和消费税。2015年前,新注册纯电动汽车和充电式混合动力汽车免征车船税,普通混合动力汽车减半征收车船税。

另外,节能与新能源汽车及其关键零部件研发和生产将被列入《国家重点支持的高新技术领域》,享受国家有关高新技术企业所得税税收优惠政策。对节能与新能源汽车及其关键零部件生产、研发企业从事技术转让、技术开发业务和与之相关的技术咨询、技术服务业务所取得的收入,免征营业税。

新能源汽车准入管理加强

在加强准入管理的同时,《规划》讲加大对符合条件的新能源汽车企业的支持力度。比如,鼓励银行等金融机构对符合条件的新能源汽车产业发展项目、新能源汽车产业基地基础设施提供信贷支持。同时,政府机构也将优先支持符合条件的节能与新能源汽车及关键零部件企业在境内外上市、发行企业(公司)债券等,充分发挥现有上市公司的再融资功能。

值得注意的是,《规划》也提出,要建立和完善小型低速纯电动汽车标准法规体系,对小型低速纯电动汽车实行有别于汽车的特殊准入管理制度。这意味着,一些小型低速纯电动汽车可能被放行,不过,此处所指的小型低速纯电动汽车并非人们所说的“山寨电动车”。

Why big dams and big ag are good for the poor

Recently, I interviewed John Briscoe, a Harvard professor and development expert who has spent decades thinking about how poor countries get richer, with a particular focus on water. He has come to believe that large-scale dams and genetically-engineered foods can be good for poor countries.

These are controversial views. See, for example, the website of a nonprofit group called International Rivers, which says:

Africa’s dams have done considerable social, environmental and economic damage, often with complete disregard for the human rights of dam-affected communities, and have left a trail of “development-induced poverty” in their wake.

Friends of the Earth, meanwhile, says that it “opposes the introduction of GMOs as it will constitute a threat to African biodiversity and the continent’s food sovereignty, and will make nothing to help Africa tackling poverty and hunger.”

Here’s an edited version of our interview:

Marc Gunther: John, let’s begin by talking about water. You’ve called water scarcity “a massive and growing problem in the developing world.” What do you mean by that? Are you talking about drinking water and sanitation? Or water more generally? And if it’s the latter, why is it that we are experiencing scarcity since there is, essentially, a finite amount of water in the world? We don’t deplete our supply of water like we do, say, our supply of oil.

John Briscoe: I think it’s useful to think about water as you suggest: There’s the resource itself and then the services that are derived from that resource. So, when it comes to drinking water and sanitation as a service, in my view, there is a large but not a growing problem. In fact, the number of people who do not have adequate water and sanitation services is shrinking. Lots of people who never had services are getting services, because of economic growth in the developing world in general and China and India in particular. Of course, one person without these services is one person too many, but the situation is improving. You see this improvement reflected in the rapid decline of infant mortality rates in many countries. There are important financing and institutional issues for delivering these services, but for societies at large, I do not consider that a huge, massive, existential challenge.

The greater challenge in countries like India, Pakistan and China is that the resource itself, as you said, is finite, and the demands on it are ever-increasing. We need more agriculture to grow our food. We need more energy. We need more industry. We need more water and sanitation. It’s essentially a Malthusian problem of a limited resource and the ever-growing demands on it. And that is a massive problem.

MG: For the west, or just for the developing world?

JB: Water is always a local issue. So you can’t call it a problem throughout the developing world. But it’s a massive problem in many places, particularly in the large parts of the developing world which the God-given endowment (of water) was relatively small; so a great swath across the Middle East, North Africa, into India and in China, where you have limited resources and a very large number of claimants.

Details matter a lot, but typically agriculture is the biggest user of water, and so in China, India, Jordan and Morocco, among other places, agriculture and its use of water is absolutely at the heart of this problem.

MG: Before we get to food and agriculture, let’s talk about an obvious response to water shortages that you’ve written about, namely, storage in dams and reservoirs.

JB: Sure. The numbers first: If we look at the amount of storage per person in the United States or Australia, there is more than 5,000 cubic meters of storage capacity and reservoirs in each of those countries per person. That’s a pretty astonishing number. If you think of “little old you,” Marc living in Maryland, somewhere, somebody’s got 5,000 cubic meters of water storage.

Why do we do that? This is all very natural. That is, over the years sometimes it rains and sometimes it doesn’t, and when it doesn’t, it’s good to have water accumulated from the rains. We capture in the wet season and use in the dry season. And we capture it in wet areas and move it to dry areas.

MG: This has been going on for millennia.

JB: Indeed. The other reason why that’s important is that we have dry years and wet years, so we store not only over seasons but over year. Of course, it’s a geographic issue as well. I’m from South Africa, where most of the rain falls in a small coastal belt. Most of the industry and minerals and agriculture are in the interior where there’s not much rain. So we store where it’s plentiful and move to where it’s dry. In the U.S. we store water from the Colorado River and put a big pipe to Los Angeles.

MG: Poor countries don’t do that?

JB: If you look at two extreme cases, Kenya and Ethiopia, they have, not 5,000 cubic meters per person, but about 50, so two orders of magnitude less. According to a study done by my former colleagues at the World Bank, if you look over the last 25 years at the economic growth of Ethiopia, you see that it is almost perfectly correlated with rainfall. In other words, when it comes to this whole protective role of infrastructure in getting us through the very dry and very wet periods to try to even things out–they have no such protection, and therefore they are essentially at the mercy of nature.

What’s also very important is the use of hydropower potential. The United States, Western Europe, Japan, all countries in developed parts of the world that have significant hydro potential, have used more than 80 percent of that potential. In Africa, they’ve used 3 percent.

So you have countries like Norway and Switzerland and others that have developed 90 percent of their hydro potential, then sitting on the boards of their aid agencies and the World Bank and they say to Ethiopia, “We don’t like dams. We don’t like hydropower. You can’t have it. We won’t support it.” This is done in the name of environmental concern and it’s deeply, deeply resented by these countries.

The good news, in my view, is the Chinese, with their trillion dollars of reserves, are now investing a lot in these sorts of investments in places like Africa and they are very well received for so doing. China’s building more than 200 dams outside of China, compared to a handful by the World Bank.

MG: And the opposition to dams is based on environmental concerns?

JB: That’s one concern, but in poor countries the larger concern is usually social. There is a very important issue in that people live in river valleys and you build reservoirs and they displace people, sometimes on a very large scale. There, the absolutely essential issue is to make sure that those people are the first beneficiaries of these projects, not the collateral damage,

MG: Let’s now turn to food and agriculture. You’ve said that “Water and food challenges are two sides of the same coin.”

JB: Yes. I think the energy, water, and food—this is a bad metaphor–but they are three sides of the same coin. You can hardly deal with one without the others. They all are interrelated.

Here there’s an extremely worrying situation. Look back to the 1960s and the success of the Green Revolution. People were saying that poor countries like Bangladesh could never feed their people. We now have India, Bangladesh, all these places, essentially, self sufficient in food production. We had in the 1960s and 1970s a yield growth of 3 to 4 percent a year. This was just incredible and had huge positive impacts. Even today, food prices are less than half than what they were in 1960 in real terms. So, this has been, in my view, one of the greatest achievements of science, contributing to the well-being of billions of people.

MG: But those gains are petering out, correct?

JB: Essentially, yes. Because the scientific ingredients of the Green Revolution have largely run their course, we now have yield improvements of half a percent and one percent, with large growing populations. and markets are becoming very, very thin. When there is some disturbance, the market tips and we food crises as in 2008.

Let me give an example: I lived in Brazil for the last three years. Brazil has had an amazingly positive experience. The value of agricultural output in Brazil today is three times what is was 35 years ago and Brazil is an agricultural superpower, one of the biggest producers of bio-fuels, of soy beans, meat, fruits, etc.

It turns out that of that 300 percent increase in production, 90 percent is attributable to productivity increases. Only 10 percent of that increase is accounted for by increases in input of land, labor, and capital. Most it comes from being much smarter. This is because Brazil over this period – even through hyper-inflation, through economic crises — never stopped investing massively in agricultural research. So they have today, without anybody being a close second, a research establishment on tropical agriculture that is by far the best in the world. They’ve seen enormous returns on investment in agricultural research.

Strikingly, look at that same period and see what the development agencies, including the World Bank, did in agriculture. In 1975, about 20 percent of development assistance went to agriculture because it was, in my view, correctly perceived that agriculture was one of the bedrocks on which countries developed. By 2008, agriculture had slipped from 20 percent to around 3 percent of official development assistance.

Why? Like all things, it’s complex. One contributor was that there was a lot of opposition to modern agriculture from green groups, environmental groups and others who don’t like irrigation and large scale agriculture, just as there was opposition to large-scale infrastructure. There was also a sense that the private sector would take care of this. The private sector, of course, does do quite a bit with agricultural research, but there is an enormous role for the public sector as well.

So, we get to 2008 and I was actually in Brazil when the food crisis struck. TheInternational Assessment of Agricultural Knowledge, Science and Technology for Development — a twenty million dollar project done by the World Bank and 17 other partners – then came out telling us why the Brazilian approach (heavily scientific, large scale, and technologically sophisticated) was the wrong way to go and that the right way was small, beautiful and organic. And the Minister of Agriculture of Brazil quite rightly tore me to pieces and said, “This is bizarre….”

In my view, there’s a deep problem with the aid business. You read the UNMillenium Development Goals and in my view they put the social cart before the economic horse. They are all about social outcomes, but nothing on the economy that’s produced those outcomes, so infrastructure doesn’t figure, agriculture doesn’t figure. These global solutions are driven by rich countries and rock stars and just sort of run from fashion to fashion.

Fortunately, I think what is very good in the international scene is the rise of the middle income countries, like China, India and Brazil. They are much closer to the issues of poverty, much more pragmatic, much less ideological and bring much more common sense to the discussion.

MG: Interestingly, those countries are growing more biotech foods as well, which brings me to my last topic. When you talk about technologically sophisticated agriculture, do you believe the GMOs have a role to play?

JB: Absolutely. And it’s not only GMOs. There’s no question that the need to find the next generation of technology for food production is absolutely staring us in the face. As we run into environmental constraints around the use of pesticides, fertilizers, etc., we need to find crops that produce the same output with much less input of water, fertilizers and pesticides.

So if you look at the report released from the National Academy of Sciences you find that farmers in the United States are very happy with these crops and they have brought about very substantial reductions in the use of pesticides and fertilizers. Of course, we have to deal with issues of monitoring and regulation. The legal and regulatory environment must be one that safeguards consumers.

MG: But there’s still controversy holding back GMOs.

JB: Europe doesn’t want to consume any of these, although their beef is still fed from soy beans from Brazil that’s all GMOs. Telling Africans they can’t grow GMOs, because they won’t be able to sell it in Europe–to me is absolutely, morally indefensible.

But China, India and Brazil are all moving ahead expeditiously, with their eyes open, but moving ahead very fast. That bodes well for the world and for its need for more food.

Subscribe to:

Posts (Atom)